Understand Credit Card Interest Calculation

Understanding how credit card interest is calculated is crucial for managing your finances effectively. Credit card interest can significantly impact your overall debt, and knowing how it works can help you make better financial decisions.

Understanding APR (Annual Percentage Rate)

APR is the yearly interest rate you'll pay on your credit card balance. However, credit card companies typically divide this rate by 365 to calculate your daily periodic rate, which is then applied to your daily balance.

Understanding Credit Card Interest: The Hidden Costs of Revolving Credit

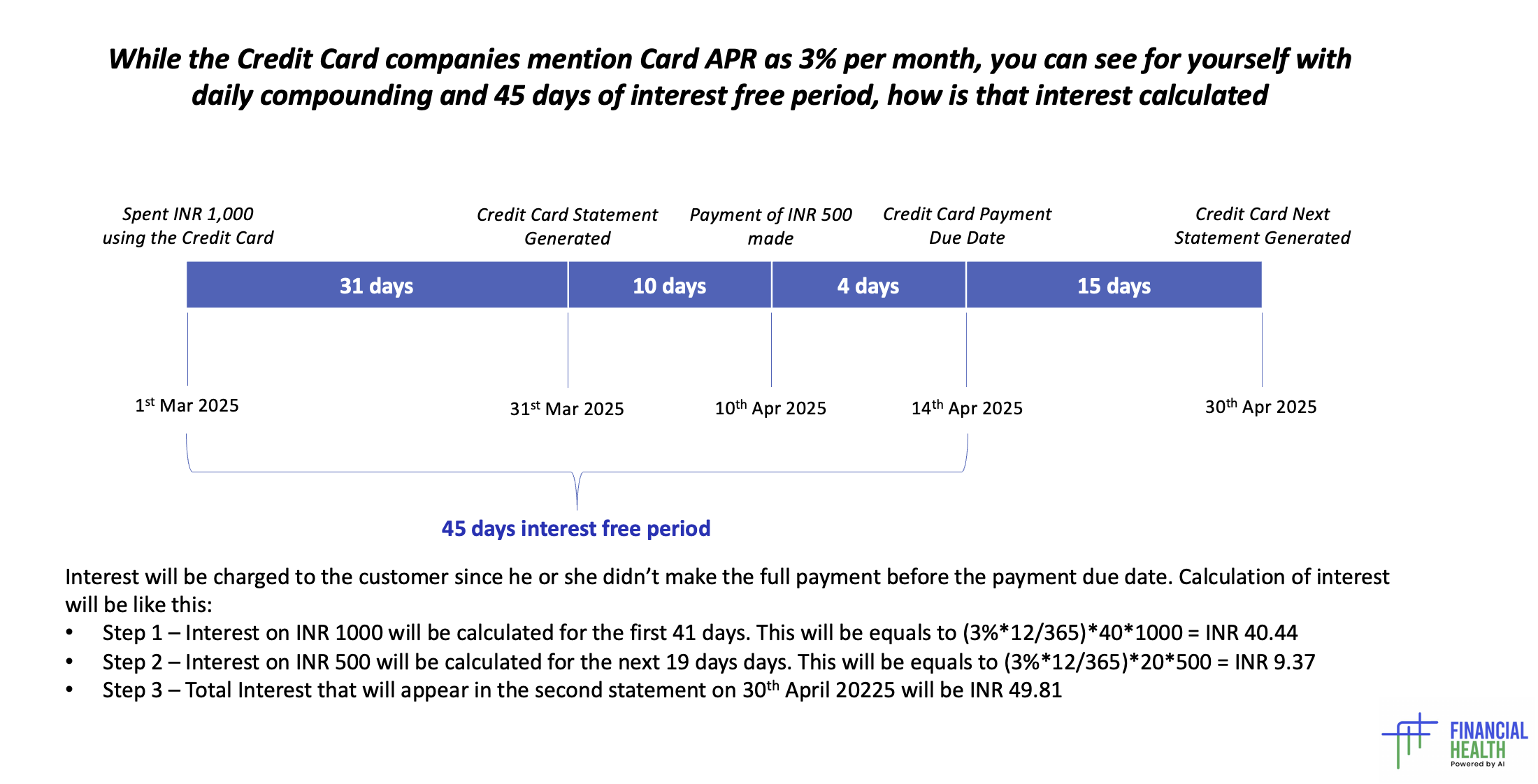

Many credit card users assume they will be charged interest only on ₹500 for 19 days—the period before the next statement is generated. However, the larger interest component actually stems from the ₹1,000 that remained unpaid for the first 41 days. This means there is no interest-free period, a crucial detail that many customers overlook. Banks classify such users as "Revolvers", applying interest on transactions from the moment they are made.

To avoid high credit card interest rates and maximize your interest-free period, always aim to pay your total outstanding balance on time. Understanding how banks calculate interest can help you manage your finances smarter and save more.

Comparison for a few Credit Cards

Regalia Credit Card

Bank: HDFC Bank

APR: 36-42% p.a.

Annual Fee: ₹2,500

Key Rewards:

- 4X rewards on travel & dining

- Airport lounge access

- Milestone benefits up to ₹12,000

Ace Credit Card

Bank: Axis Bank

APR: 37-42% p.a.

Annual Fee: ₹499

Key Rewards:

- 5% cashback on bill payments

- 2% on other spends

- Welcome benefits worth ₹5,000

Amazon Pay Card

Bank: ICICI Bank

APR: 36-42% p.a.

Annual Fee: ₹500

Key Rewards:

- 5% rewards on Amazon

- 2% on digital payments

- 1% on other spends

811 Dream Different

Bank: Kotak Bank

APR: 36-40% p.a.

Annual Fee: ₹0

Key Rewards:

- Zero joining and annual fee

- 1% cashback on all spends

- Movie ticket discounts

| Card Name | Bank | APR | Annual Fee | Key Rewards |

|---|---|---|---|---|

| Regalia Credit Card | HDFC Bank | 36-42% p.a. | ₹2,500 |

|

| Ace Credit Card | Axis Bank | 37-42% p.a. | ₹499 |

|

| Amazon Pay Card | ICICI Bank | 36-42% p.a. | ₹500 |

|

| 811 Dream Different | Kotak Bank | 36-40% p.a. | ₹0 |

|

Key Comparison Points:

- • Lowest APR: Kotak 811 Dream Different (36-40% p.a.)Apply Now →

- • Best Rewards Rate: Axis Ace (5% on bills)Apply Now →

- • Premium Benefits: HDFC RegaliaApply Now →

- • Best for Online Shopping: Amazon Pay CardApply Now →